Let’s be real—your gym needs top-notch equipment to pull in new members and keep the ones you have. But emptying your bank account to get it is a classic mistake. The smart question isn't if you should finance, but how. For experienced gym owners, financing gym equipment is the standard playbook. It lets you use someone else's money to start making your own money from day one.

Why Financing Is a Strategic Move, Not a Last Resort

First, let's kill the idea that all debt is bad. In the gym business, cash flow is your lifeline. Every dollar you hold onto is a dollar you can put toward marketing, payroll, or that surprise A/C repair on the hottest day of the year.

Dropping $50,000 in cash on new equipment might feel "responsible," but it leaves you exposed. Financing, on the other hand, converts that huge capital expense into a predictable monthly operating cost. That new gear starts paying for itself immediately through new memberships and happier clients.

Keep Your Cash Flow Healthy

Smart operators guard their working capital. Financing frees up your cash for the things that actually grow your business and keep the doors open. This isn't just business school talk; it's having the cash on hand to launch a killer marketing campaign or cover payroll when a few big membership payments fail. Don’t let a row of shiny treadmills drain your ability to actually run your gym.

Get the Right Gear, Right Now

The fitness world changes fast. Your members expect modern, reliable equipment. If you don't provide it, they'll find a gym that does. Financing helps you get the equipment your members are asking for today, not six months from now when you’ve finally saved up.

The global market for gym equipment is exploding—it's projected to hit USD 27,420.9 million by 2033. Lenders get it. They often use the equipment itself as collateral, which makes approvals much easier and allows most new gyms to get fully kitted out without draining their savings.

Here's the bottom line: Your equipment is an asset that makes you money. Financing lets that asset generate revenue while you pay it off, rather than forcing you to take a massive financial hit upfront.

By using financing, you transform a major purchase into a strategic investment. If you're in the early stages, it’s also a good idea to check out a complete guide on how to start a gym business to see how equipment costs fit into the overall puzzle.

Decoding Your Financing Options

Alright, you have your equipment wishlist. Now, how do you pay for it? You have options, but they aren't created equal. This is where a lot of gym owners get bogged down, trying to decipher confusing terms when they should be on the gym floor.

Let's cut through the noise and break down your main choices.

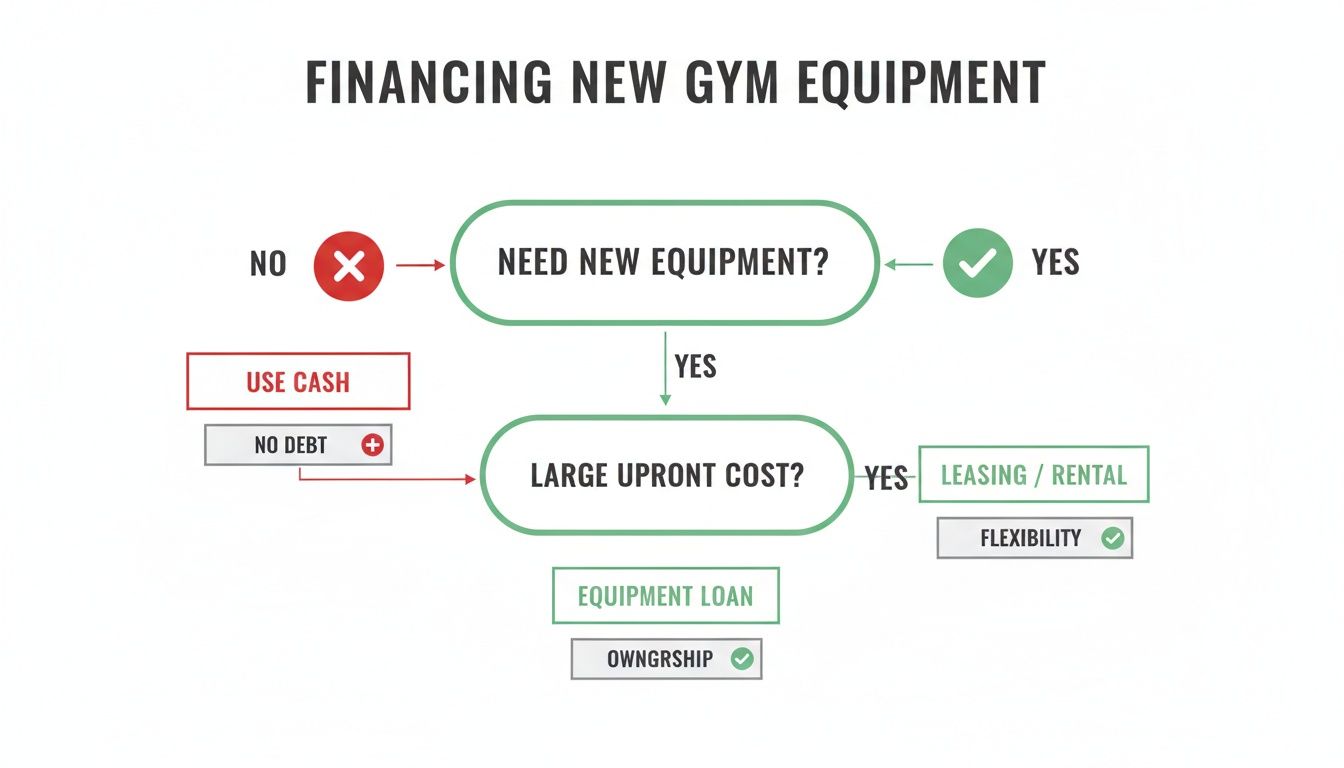

This flowchart lays out the basic decision path every gym owner faces.

The main takeaway is simple. Unless you're sitting on a massive pile of cash, financing is the smart play. It lets you preserve the money you need for day-to-day operations.

Comparing Your Gym Equipment Financing Options

Here’s a quick comparison table. Think of it as your cheat sheet for figuring out which path makes sense for your gym. It's a no-nonsense breakdown of the most common methods.

Financing Type | Who Owns It | Typical Term | Best For |

|---|---|---|---|

Equipment Loan | You | 2-7 years | Building long-term equity with foundational equipment like squat racks and free weights. |

Equipment Lease | The Lender | 2-5 years | Tech-heavy machines with a short shelf life (e.g., treadmills) or if you want lower monthly payments. |

SBA Loan | You | 7-10 years | Major expansions or outfitting a new facility; you'll need patience for the paperwork. |

Line of Credit | You | Revolving | Unexpected repairs, smaller purchases, or bridging short-term cash flow gaps. |

There's no single "best" option—it all comes down to what you're buying and your long-term goals.

A Closer Look At The Most Common Routes

You'll generally run into four main paths when you start looking for funding. Each one has a specific job, just like a piece of equipment in your gym.

Equipment Loans

This is the most straightforward route. You get a loan to buy equipment, and that gear acts as the collateral. It’s perfect for foundational, long-lasting pieces like power racks, benches, and dumbbells. You own it, you build equity, and you have a predictable monthly payment.

Equipment Leasing

Think of this as renting with an option to buy. Leasing is smart for tech-heavy machines that get outdated quickly, like high-end treadmills or body scanners. Your monthly payments are usually lower, and you can upgrade to the latest models when your lease is up.

SBA Loans

These are government-backed loans with great interest rates and long repayment terms. The trade-off? A mountain of paperwork and a slow approval process. An SBA loan is a tool for established gyms planning a major expansion, not for a quick purchase.

Business Lines of Credit

This works like a credit card for your business. You're approved for a limit and can draw from it as needed. It’s ideal for smaller purchases or covering an unexpected equipment failure—not for outfitting an entire facility.

The fitness equipment market is projected to grow by USD 4.85 billion by 2029, and flexible financing is a big reason why. Leasing can slash ownership risks by as much as 40%, letting you keep cash for marketing and staff—the things that actually bring members in. This approach also helps new owners secure funding up to 30% faster than going through a traditional bank.

Your goal isn't just to get a "yes" from a lender. It's to match the right financing tool to the right business need so the terms work for you, not against you.

For a deeper dive into your choices, checking out a comprehensive guide to equipment financing options can help, even if it's from another industry. The principles are the same. A bad financing deal quickly turns into an admin headache that steals hours you should be spending on the floor.

Getting Approved Without the Hassle

Lenders don’t have time to waste, and neither do you. A messy, disorganized application is the fastest way to get a 'no'. Your goal is to look like a sharp, professional operator who has their numbers dialed in—not someone digging through file cabinets.

Think about it: a clean application package doesn't just increase your odds of approval. It gets you better terms and saves you from a week of back-and-forth emails. That’s time you should be spending with your members, not stuck in your inbox.

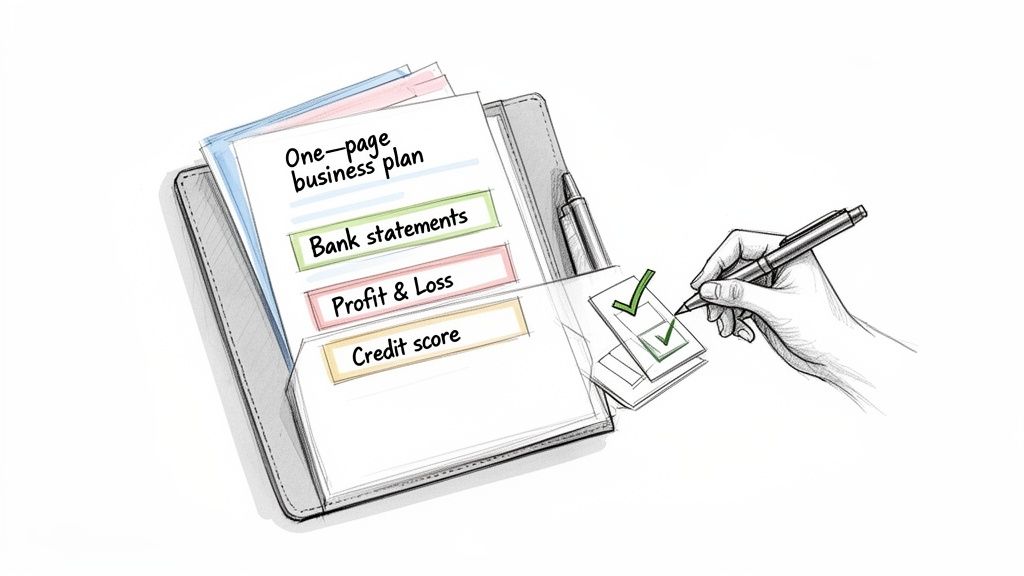

Your Pre-Approval Checklist

Before you call a lender, get your financial house in order. Walking in with everything ready puts you in the driver's seat.

Here’s the bare minimum you need on hand:

- A One-Page Business Plan: Forget the 50-page novel. Lenders need a snapshot: who you are, who you serve, and exactly how this new equipment will make more money. Keep it short and focused on revenue.

- Recent Bank Statements (3-6 Months): This is non-negotiable. They need to see consistent cash flow. Frequent overdrafts or a balance always near zero are major red flags.

- Profit & Loss (P&L) Statement: Your P&L tells the story of your gym's health. A clean report showing steady revenue is your single best negotiating tool.

- The Equipment Quote: Get the official, detailed quote from your vendor. It must break down the exact cost, plus taxes, delivery, and installation.

The bottom line is this: Lenders are betting on your ability to make payments. Your paperwork is the evidence that proves your gym is a safe bet. Don't make them dig for it.

What Lenders Actually Care About

Lenders are trying to answer two simple questions: Can you pay us back? And will you pay us back? Your numbers tell them everything.

Your Credit Score

There's no single magic number, but a personal credit score of 650 or higher puts you in a great position for good rates. Since the equipment itself serves as collateral, some lenders might go lower—even into the low 600s—but you’ll pay for it with a higher interest rate.

Your Cash Flow

This is even more critical than your credit score. Lenders will scan your bank statements to confirm you have enough free cash flow each month to cover the new payment. They’re looking for a clear buffer, not a gym that’s just scraping by.

Having your financials organized is key. You should be able to pull these reports in minutes. If you’re still wrestling with spreadsheets, it’s time to look into a unified fitness studio management software that keeps these numbers at your fingertips. It eliminates the admin chaos and makes you look like the professional you are.

Negotiating Terms Like a Seasoned Operator

Let’s be honest: the first offer a lender gives you is rarely their best one. Too many owners, buried in the day-to-day grind, just sign on the dotted line. Don't make that mistake—it’s leaving cash on the table.

Pushing back isn't about being difficult. It's about knowing your numbers and respecting your business. A few pointed questions can save you thousands over the life of your loan. You want to come across as a serious operator, not someone who will take whatever they can get.

Focus on These Three Levers

When it comes to financing gym equipment, you have more negotiating power than you think. Focus your energy on the three areas that have the biggest impact on your bottom line.

- The Interest Rate: This is the big one. If you have a solid credit score (above 675) or a hefty down payment, you have leverage. Use it. A simple "With my credit score and a 20% down payment, I was expecting a rate closer to X%. Can you get us there?" can work wonders.

- The Repayment Term: A longer term means a lower monthly payment, which is great for cash flow. The catch? You'll pay more in total interest. Ask the lender to model the numbers for different terms—say, 3, 5, and 7 years. Lay them side-by-side and see how each affects your budget. Choose what works for your gym's long-term health.

- Prepayment Penalties: This is a sneaky trap. Some loans charge you a fee for paying off your debt early. Ask directly: "Are there any prepayment penalties?" You want the freedom to pay it off ahead of schedule if you have a killer quarter, without getting dinged for it.

Here's the key takeaway: Lenders expect you to negotiate. When you walk in prepared and confident about your financials, they see you as a good investment, not a risk.

Coming to the table ready to discuss these points shows you’ve done your homework. It changes the dynamic from a simple transaction to a partnership and can make a massive difference in the terms you get.

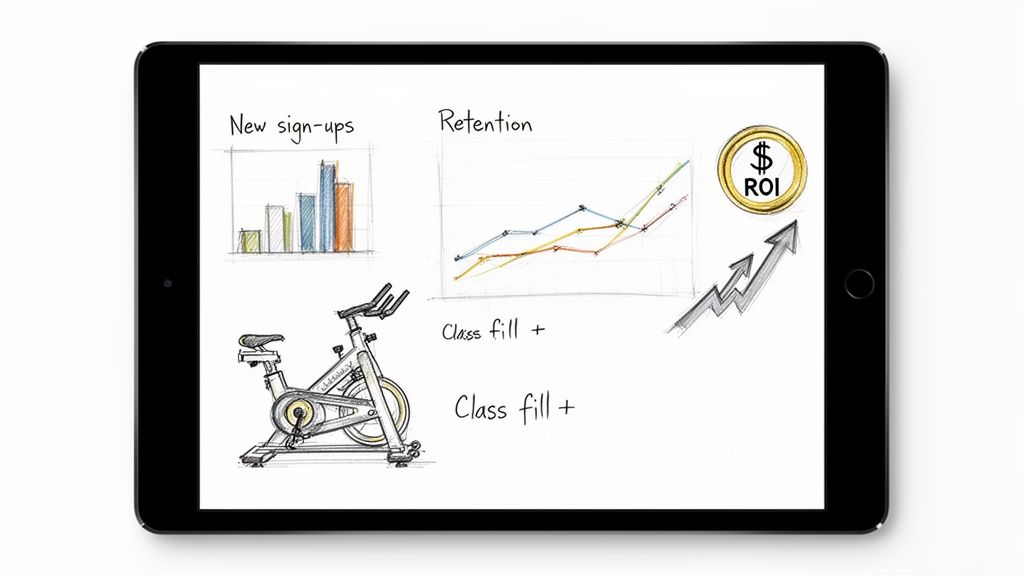

Tracking Your Equipment ROI From Day One

The financing is approved, the new gear is on the floor. Great. Now comes the real work: making sure it pays for itself. That new monthly payment is a fresh line item in your budget, and you need to know—with hard numbers—if that equipment is pulling its weight.

This is where a solid gym management system moves from a "nice-to-have" to an absolute necessity.

Forget about getting buried in spreadsheets for hours. Your dashboard should give you an instant, clear picture of how your new assets are performing. You have to connect the dots between the purchase and your key metrics. This is how a loan stops feeling like a debt and starts acting like an investment that grows your business.

Connecting Equipment to Revenue

The point of financing gym equipment is to bring in more money than the monthly payment costs you. To see if this is happening, you have to link each piece of equipment to specific performance indicators.

Think about it this way:

- New Spin Bikes: Are your class fill rates climbing? Is the waitlist longer? A good system shows you this data in real-time, giving you concrete proof that the bikes were a smart move.

- 24/7 Door Access System: Are you seeing a jump in off-peak check-ins? Did you cut staffing costs? Are new members signing up specifically for that flexibility? This directly justifies the cost.

- Upgraded Dumbbell Set: Have personal training session bookings ticked up? Are you keeping more of your serious lifters? Check our guide on the essential fitness center equipment list to see how different pieces contribute to your bottom line.

The goal is to move beyond gut feelings. Data tells the real story. If that new leg press isn't driving new sign-ups or increasing usage, you know not to buy another one.

This data-backed approach proves every dollar you borrowed is working for you. The commercial fitness gear market is projected to hit USD 3.25 billion by 2032; financing makes these upgrades possible. In fact, globally, 55% of all gym equipment purchases are now financed, giving owners the tools they need to grow without draining cash.

The Simple ROI Calculation

You don’t need a finance degree to figure out your ROI. You just need to know what revenue you can attribute to the new gear.

First, identify the new monthly revenue it’s generating. Let’s say your new squat racks helped you sign up 10 new members at $50/month. That’s $500 in new revenue.

Next, subtract the monthly financing payment. If the loan for those racks costs you $200/month, your net return is a healthy $300.

Beyond just financing, understanding the potential returns on any investment is crucial. For instance, businesses in the wellness sector often analyze how new assets contribute to overall revenue, finding strategies for boosting business with commercial equipment. Adopting this mindset ensures every purchase has a clear purpose.

When your gym management software tracks this for you automatically, it eliminates the guesswork. You can then make your next financing decision with total confidence, knowing you're investing in proven revenue streams, not just buying equipment.

Common Questions About Financing Gym Equipment

You’ve got questions about financing gym equipment? You're not alone. Every smart operator asks these before they sign anything. Let's get straight to the no-nonsense answers.

What Credit Score Do I Need?

Most lenders feel comfortable with a personal credit score of 650 or higher. Landing in that range usually opens the door to the best rates.

But don't panic if you're not there. Equipment financing companies are more flexible than traditional banks because the equipment itself is the collateral.

If your score is in the low 600s, you can still get approved, but expect a higher interest rate or a request for a larger down payment. Strong business revenue can often make a lender look past a less-than-perfect score.

Is It Better to Lease or Buy Gym Equipment?

This comes down to the gear and your long-term strategy. Here’s a simple rule of thumb.

Buying (through a loan) is almost always better for foundational, durable pieces. Think squat racks, dumbbells, and benches—the workhorses that hold their value for a decade. You build equity and you own the asset.

Leasing is a smarter play for tech-heavy machines that get outdated in a few years, like high-end treadmills or body scanners. Leases usually come with lower monthly payments and give you the flexibility to upgrade when the term ends.

The takeaway is simple: Buy what holds its value, and lease what depreciates quickly. This protects your cash and keeps your facility feeling fresh.

Can I Finance Used Gym Equipment?

Absolutely, and it can be a smart way to stretch your budget. Many lenders will finance used equipment, especially from a reputable reseller. The terms will likely be different.

Since used equipment has a lower resale value, lenders might offer shorter repayment periods or ask for a larger down payment to lower their risk. Before you pull the trigger, get a thorough inspection report and confirm your lender is comfortable with the age and condition of the pieces. The savings can be huge, but you don't want to finance someone else's maintenance nightmare.

How Much of a Down Payment Is Required?

The down payment can swing from zero to 20%. It depends on the lender, the type of financing, and your gym's financial health.

A huge perk of equipment-specific loans and leases is that they often require very little cash upfront—sometimes just the first and last month's payment. That’s a massive win for your cash flow.

For other options like SBA loans, or for operators with weaker credit, a down payment of 10-20% is more common. On the flip side, offering a larger down payment can be a great negotiating tool to lock in a lower interest rate, saving you money over the life of the loan.

Stop wasting time chasing payments and wrestling with clunky software. Fitness GM is the all-in-one gym OS that runs your billing, access, and scheduling in the background so you can focus on your members. See how you can save 12+ hours a month on admin and capture lost revenue by visiting the Fitness GM website and starting your free trial.