How much does it really cost to open a gym? The honest answer: it varies, a lot. You could be looking at anywhere from $50,000 for a small, no-frills facility to over $250,000 for a high-end studio. The final number comes down to your vision—the size, location, and the kind of experience you want to give your members.

Your Realistic Gym Startup Budget

Forget vague estimates. You need real numbers to build a business plan that actually works. Your initial investment is the first hurdle, and getting it wrong puts you on the back foot from day one. It’s the unexpected costs that trip up new owners before they even get a chance to build momentum.

Think beyond squat racks and treadmills. Your startup budget is everything: the lease deposit, construction, your initial equipment package, and the admin work to open your doors legally. Every choice, from the flooring you install to the lights you pick, eats into your total budget.

Know Your Numbers From Day One

Different gyms have wildly different price tags. A small, 24/7 key-card gym has a much lower entry barrier than a premium boutique studio with specialized gear and luxury amenities. To get a handle on the road ahead, a smart approach to budgeting and forecasting is non-negotiable.

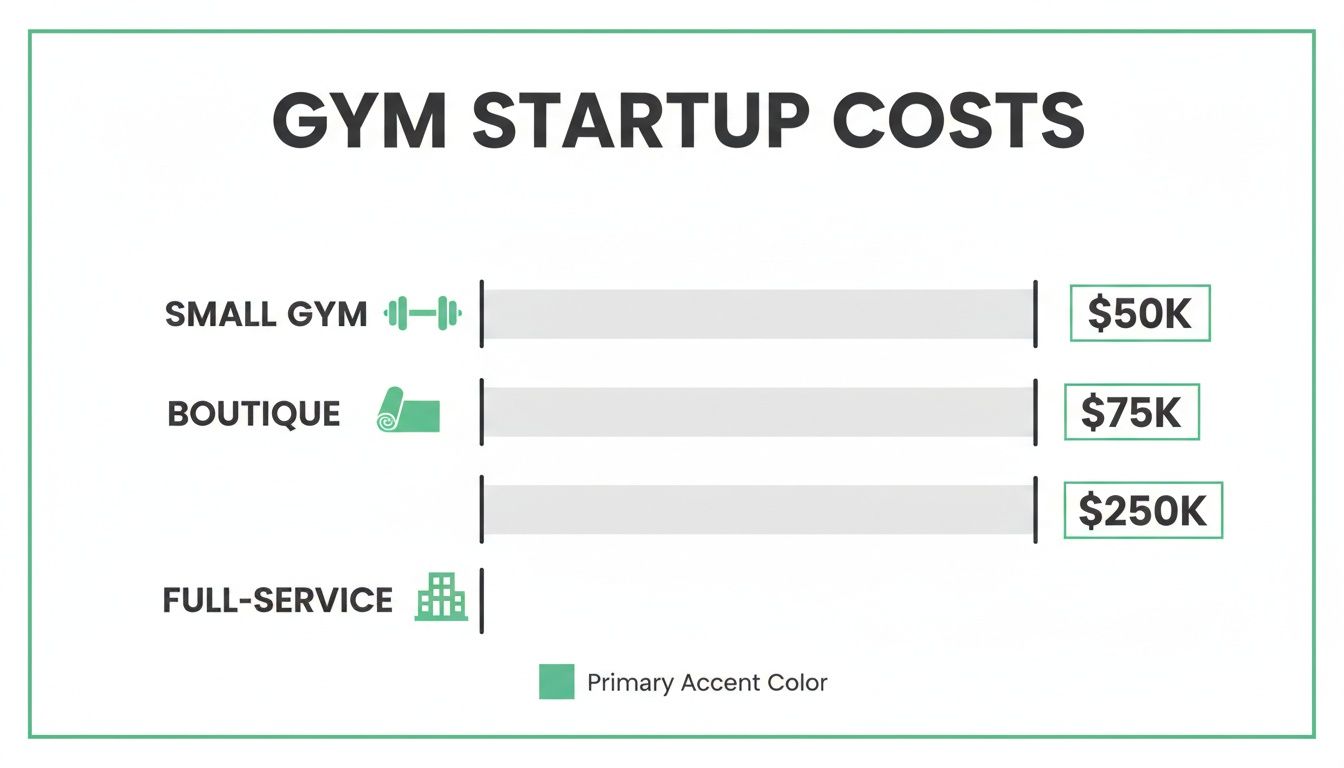

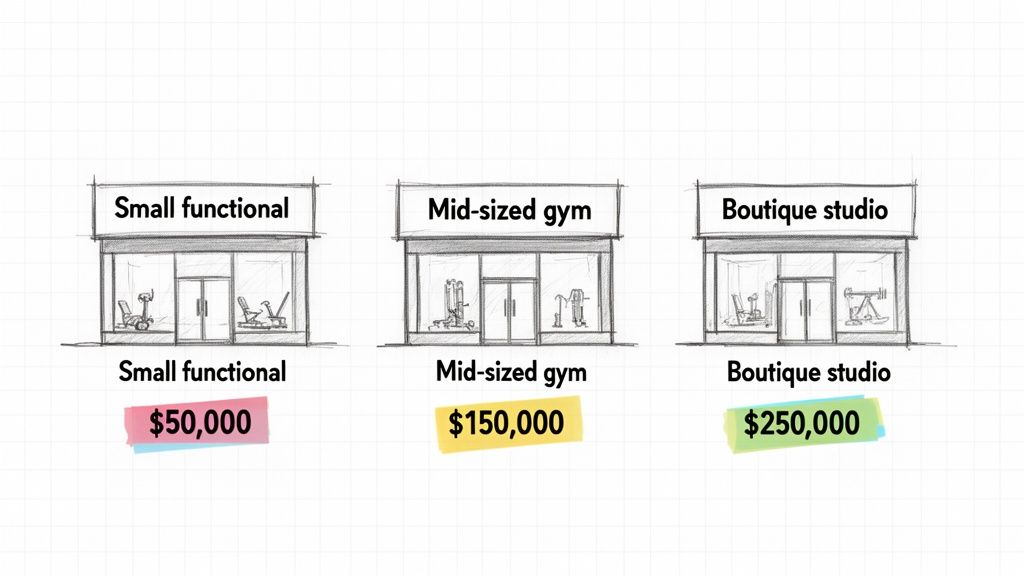

Let's look at some typical ranges. A small, functional gym often requires an investment between $50,000 and $150,000. If you're planning a boutique spot, like a dedicated yoga or HIIT studio, budget for something in the $75,000 to $250,000 range. For a traditional, full-service gym, the costs can easily climb from $250,000 to $500,000, with some franchise models going much higher.

The infographic below gives a solid visual breakdown of the investment for common gym models.

Startup Cost Ranges by Gym Type

To make it even clearer, here’s a quick comparison of what you can expect to invest.

Gym Type | Typical Low-End Cost | Typical High-End Cost | Key Cost Drivers |

|---|---|---|---|

Personal Training Studio | $30,000 | $75,000 | Smaller footprint, specialized but limited equipment. |

Boutique Fitness Studio | $75,000 | $250,000 | High-end finishes, specialized gear, prime location. |

24/7 Access Gym | $50,000 | $150,000 | Security systems, less staff, efficient layout. |

CrossFit Box | $40,000 | $100,000 | Open space, rigs/racks, minimal cardio machines. |

Full-Service Gym | $250,000 | $500,000+ | Large square footage, diverse equipment, amenities. |

As you can see, the jump from a basic facility to a full-service operation means a major jump in your capital needs. This is almost always driven by needing a larger space and a much more extensive equipment inventory.

The biggest mistake I see new owners make is underestimating these one-time costs. A bulletproof budget accounts for everything—from the security deposit on your lease to the final coat of paint on the walls—giving you a clear path to opening day without burning through your cash reserves on problems you didn't see coming.

Your goal is to build a thriving business, not a money pit. The first step is knowing exactly what you’re up against financially. This guide will walk you through every line item so you can stop guessing and start building a gym that’s set up to win.

Decoding Your One-Time Startup Costs

This is the money you'll spend before you sell your first membership. It’s the cash you burn to get the engine running. If you miscalculate here, you’ll be fighting an uphill battle from day one.

Let’s break down these non-negotiable startup expenses into three buckets: your facility, your equipment, and the administrative stuff that happens behind the scenes. These are the one-time hits to your bank account you must plan for. Get them right, and you'll avoid the nasty financial surprises that can sink a new gym before it even opens.

Nailing Down Your Facility Costs

Your physical space is almost always your single biggest upfront expense. Before you think about what treadmill to buy, you need to lock down a location and get it ready.

- Lease Deposit: Most landlords will ask for a security deposit, usually one or two months' rent. For a 3,000-square-foot space, that could easily be $5,000 to $10,000 gone right off the bat.

- Renovations & Build-Out: This is where budgets get blown out of the water. Depending on the building's condition, you could be looking at anything from $5,000 to over $100,000. This covers everything from specialized rubber flooring and building out locker rooms to upgrading the HVAC system so it can handle a room full of sweaty people.

- Signage: Don't underestimate the power of a good sign. Professional branding on your building is critical for catching the eye of potential members and can run you anywhere from $1,000 to $5,000.

Trying to cut corners on flooring or air conditioning is a classic mistake. You'll only end up with expensive repairs and unhappy members down the road.

Equipping Your Gym The Smart Way

Next up: the gear. This is what your members pay for, so it's a huge part of your startup cost calculation. The good news is, you have options that can dramatically change how much cash you need upfront.

You can buy new, buy used, or lease. Buying new gets you shiny, warrantied gear, but it requires the most capital. Leasing keeps your initial costs down but means you'll pay more over the long haul. For a deep dive into what you'll need, check out our guide on building a complete fitness center equipment list.

A basic package for a small or mid-sized gym will likely include:

- Strength Equipment: Racks, benches, barbells, dumbbells, and some plate-loaded machines.

- Cardio Machines: The essentials like treadmills, bikes, and rowers.

- Functional Fitness Gear: Kettlebells, medicine balls, resistance bands, and maybe a small turf area.

Expect to spend between $10,000 and $50,000 for a solid starting equipment package. The key is to remember you don't need every single machine on day one. Start with the essentials that serve your target member, and you can always add more as you grow.

The Hidden Administrative Costs

Finally, we have the "soft costs." These are all the administrative and legal hoops you have to jump through before you can legally open. They aren't as exciting as a new leg press, but they're every bit as important.

These costs typically include:

- Business Licenses & Permits: This varies by city and state, but you should budget $100 to $500 to get your paperwork in order.

- Legal & Professional Fees: You’ll want a lawyer to look over your lease and draft your member waivers. This can run from $1,500 to $5,000. If you're in Canada, for example, you'll need to factor in the real cost to incorporate in Canada, which includes government and legal fees.

- Insurance Deposit: Given that gyms are high-risk environments, your general liability and property insurance will require a down payment.

- Initial Marketing Push: You need to make noise for your grand opening. This means setting up a website, running some social media ads, and doing local promotions to get those first crucial members in the door. Plan on at least $2,000 here.

Ignoring these administrative costs is a rookie mistake. By mapping out every one of these expenses, you're creating a realistic financial roadmap that sets you up for a successful launch, not a last-minute scramble for cash.

Mastering Your Monthly Operating Expenses

Once the grand opening confetti has settled, your monthly operating costs become the number that matters most. This is the real test. Your startup investment was a sprint; your monthly expenses are the marathon that decides if your gym thrives or fails.

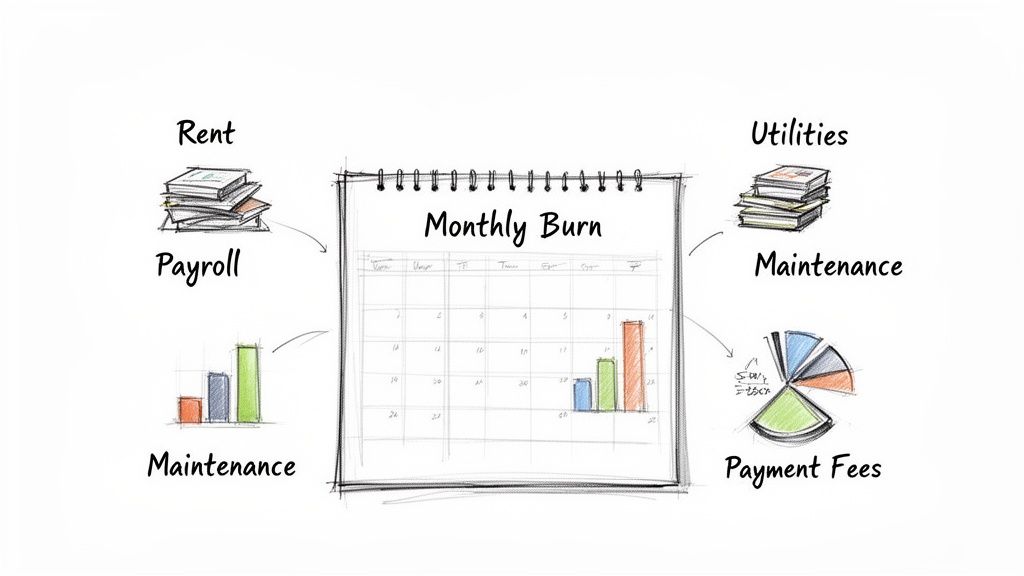

These are the recurring bills that hit your bank account every 30 days, no matter how many members walked through the door. Getting a solid grip on these numbers isn't just good business—it's the only way you’ll figure out your membership pricing and know when you’ll actually turn a profit. For a typical mid-sized gym, this monthly nut can easily top $50,000.

The Fixed Costs You Can't Dodge

Fixed costs are the predictable bills you have to pay every single month, whether you have one member or one thousand. Think of these as the foundation of your monthly gym cost. They don’t care if you had a slow month, so you have to budget for them carefully.

- Rent or Mortgage: This is almost always your single biggest line item. For a 5,000-square-foot space, a commercial lease can easily run you $10,000 to $15,000 a month, sometimes more depending on your city.

- Utilities: The lights, water, and internet have to stay on. For a gym, especially one running 24/7 with lots of equipment and A/C, expect this to be $1,000 to $3,000 per month.

- Insurance: You absolutely need general liability and property insurance. This can range anywhere from $200 to $800 a month.

- Software Subscriptions: This is where old-school, clunky software can kill your budget with hidden fees and surprise price hikes. You need tools for billing, scheduling, and member management. Bloated systems often charge you for every little feature, turning a supposed $300/month subscription into a $700/month headache before you know it.

These costs create the baseline for your monthly budget. They're the numbers you have to hit just to keep the doors open.

The real grind begins once your doors open. Monthly running costs average a staggering $56,184, with a baseline of $24,100 in fixed costs and another $32,084 in base payroll before you even spend a dime on marketing. You can see a more detailed breakdown of these operating costs over at Financial Models Lab.

Taming Your Variable Costs

Variable costs are the expenses that change based on how busy your gym is. As you sign up more members, these costs go up. The trick is to manage them so your profits grow faster than your expenses.

This is where having the right systems makes or breaks you. Are you burning cash on manual tasks that a smart system could automate?

- Staff Payroll: Your team is your biggest asset, but they're also a major expense. Payroll for your trainers, front desk crew, and managers is often the largest variable cost you'll have. The goal is to run a lean team empowered by smart technology.

- Payment Processing Fees: Every time a member’s payment goes through, you’re giving a cut—typically 2.5% to 3.5%—to the payment processor. On $50,000 of revenue, that’s $1,250 to $1,750 that vanishes instantly.

- Marketing and Advertising: To keep growing, you have to keep marketing. This could be anywhere from $500 to $5,000+ a month for digital ads, social media campaigns, and local promotions.

- Equipment Maintenance & Supplies: Stuff breaks. You’ll also be constantly buying cleaning supplies, towels, and toiletries. It’s smart to budget $200 to $1,000 a month just for general upkeep and restocking.

When you’re juggling fragmented tools, you’re forced to hire more people just to manage the chaos. A unified system like Fitness GM automates things like billing and member access, which can cut your staffing needs by up to 40%. It also automatically chases down failed payments, putting thousands back into your pocket each month. That’s how you control your variable costs instead of letting them control you.

How Modern Gym Costs Have Changed

The game has changed. If you think opening a gym today costs what it did five years ago, you're in for a rude awakening. The days of throwing some weights in a warehouse and calling it a business are long gone. Basing your budget on old numbers is the fastest way to start your new venture deep in the red.

Today’s gym-goers have high expectations. They aren't just looking for a place to sweat; they want a full experience. This shift from basic weights-and-cardio rooms to a more curated, boutique feel has pushed both startup and operating costs way up.

The Rise of the "Boutique Experience"

Members now expect more than just a solid set of dumbbells. They want a clean, well-designed space with great lighting, quality locker rooms, and tech that just works—like a seamless app for booking classes. This means your initial investment in the look, feel, and function of your space will be significantly higher than it used to be.

You're not just competing with the gym down the street anymore. You're competing with every other place people spend their money. Your budget needs to reflect that. Think about:

- Higher-End Finishes: We're talking specialized flooring that can take a beating, lighting that creates a mood, and a reception area that feels welcoming, not clinical.

- Specialized Equipment: If you're running a specific type of studio—be it HIIT, yoga, or powerlifting—you need the right gear, and that often comes with a hefty price tag.

- Integrated Tech: People live on their phones. They expect to book classes, manage their memberships, and even access the gym with a tap.

These aren't optional luxuries; they're the new baseline. If you skip them, potential members will walk right past your door and into the polished, modern studio that gets it right.

Inflation and Supply Chain Realities

It’s not just about what members want. The simple costs of doing business have skyrocketed. Rising construction costs will make your build-out more expensive, and lingering supply chain snags have jacked up the price of everything from squat racks to treadmills.

The numbers don't lie. The hybrid fitness boom, combined with a 7.7% global market growth between 2020 and 2024, has completely changed the financial landscape. These days, a small gym can easily require an initial investment in the $100,000-$150,000 range. For more specialized boutique studios, that number can climb anywhere from $75,000 to $250,000. You can dig deeper into these gym market statistics to see the trends for yourself.

Your budget has to reflect today's economic reality, not wishful thinking. Underestimating how much inflation will hit your equipment purchases and day-to-day operational costs is one of the quickest ways to burn through your capital before you even have a chance to build momentum.

This new environment demands a much smarter, leaner approach to operations. You can't afford to waste money on clunky, inefficient systems. Every dollar has to count, which is why an all-in-one platform like Fitness GM isn't just a "nice-to-have." It's a core part of a modern strategy for keeping the cost of opening a gym under control by automating the tedious work that used to require more staff and more payroll hours.

Smart Ways to Cut Your Gym Operating Costs

Having a huge budget doesn’t mean your gym will succeed—spending it wisely is what counts. Once your doors are open, your monthly overhead is the number that will keep you up at night. The goal isn't just to cover your costs; it's to get so efficient that you crush them, freeing up cash to pour back into growing your business.

This isn’t about being cheap and sacrificing the member experience. It’s about plugging the leaks that silently drain your bank account every single month. We're talking about taking a hard look at major expenses like payroll and getting rid of the mind-numbing manual work that steals both your time and your profit.

Automate Your Way to Lower Payroll Costs

For almost any gym, your biggest recurring expense is your staff. The old way was to throw more people at problems: a person at the front desk for check-ins, an admin for billing, and a manager to chase every failed payment. That model is a massive cash drain.

Modern technology makes that whole approach obsolete. By automating the right things, you can run a much leaner, more profitable operation without burning out your team or yourself.

- Set Up 24/7 Access Control: Why pay someone to sit at a desk from 5 a.m. to 10 p.m.? A modern access control system using QR codes or facial recognition lets your members get in securely, anytime. This one move can cut your staffing needs by up to 40%, transforming a huge fixed cost into a smart, one-time investment. Learn more about picking the right one in our guide to gym access control systems.

- Put Billing on Autopilot: Chasing failed payments is a soul-crushing time suck. The average gym owner wastes 28 hours a month on this task alone. An all-in-one system like Fitness GM automates the entire dance—from sending reminders before a payment is due to automatically retrying failed cards. This not only recovers over $1,000 per month from failed payments but gives you back precious hours to actually run your gym.

Stop Bleeding Money on Patchwork Software

That collection of different apps you’ve pieced together to run your gym? It’s costing you more than you think. When you use one tool for scheduling, another for billing, and a third for check-ins, you create an expensive mess. You're stuck paying multiple subscription fees, fighting with systems that don't talk to each other, and wasting hours on manual data entry.

Switching to a single, all-in-one gym OS is one of the fastest ways to slash your operating costs. You get rid of redundant fees, eliminate piles of admin work, and finally get a clear picture of your business from one central dashboard.

The enemy isn't just high rent; it's the 240+ hours a year you lose to manual admin because your software is fragmented and clunky. That's time you could spend coaching, selling memberships, or planning your next expansion.

To see just how much this adds up, here's the difference between the old, fragmented way and the smart, unified approach.

Cost Savings with an All-in-One Gym OS

Operational Task | The Old Way (Fragmented Tools) | The Smart Way (Fitness GM) | Estimated Monthly Savings |

|---|---|---|---|

Member Check-in | Paying front desk staff ($1,800+/mo) for staffed hours. | Automated 24/7 access control. | $1,800+ |

Billing & Payments | Multiple tools + 28 hrs/mo of manual follow-up. | Fully automated billing and payment retries. | $700 (in saved labor) |

Scheduling | Separate scheduling app ($50/mo) + manual updates. | Integrated class and appointment booking. | $50 |

Member Communication | Separate email/SMS tool ($75/mo). | Built-in, automated communication triggers. | $75 |

Reporting & Analytics | Manually compiling data from different sources. | Real-time, unified dashboards. | $250+ (in saved labor) |

Switching to a unified platform isn't about convenience; it's a direct and significant boost to your bottom line, month after month.

Get Smarter with Equipment and Facility Costs

Beyond payroll and software, you can find serious savings in your physical space and assets without cheaping out on quality.

- Lease or Buy Used Equipment: Brand-new equipment looks fantastic, but it carries a hefty price tag. Consider leasing your main machines to keep your upfront investment low, or hunt for high-quality used gear from reputable resellers. You can often find top-tier brands for 30-50% less than their brand-new counterparts.

- Optimize Your Energy Use: Your utility bill is a silent profit killer. Switch all your lighting to energy-efficient LEDs, install programmable thermostats, and use motion sensors in low-traffic areas like locker rooms. These small tweaks can easily cut your monthly energy costs by 10-20%.

- Rethink Your Marketing Spend: Stop throwing money at old-school newspaper ads or flyers. Get focused with targeted digital marketing. A well-run social media ad campaign can reach thousands of your ideal local customers for a fraction of the cost, giving you a much higher and more measurable return on your investment.

Every dollar you save on operations is a dollar you can put toward making your gym better. By embracing automation and efficiency, you’re not just cutting costs—you’re building a smarter, more resilient, and more profitable business.

Building Your Path to Profitability

Opening your gym is just the starting line. The real race is turning a profit. All those startup and operating costs you’ve calculated lead to one make-or-break question: how many members do you actually need to break even?

If you get this number wrong, you’re not running a business—you’re running a very expensive hobby.

Your breakeven point is that magic number. It's the precise amount of revenue you need to cover every single monthly expense, from rent and payroll to your software subscription. Once you nail this down, you know exactly how many memberships you need to sell just to keep the lights on. Every member after that? That's pure profit.

Calculating Your Breakeven Point

Let's get practical. First, add up all your fixed monthly costs. These are the bills that don't change, like rent, insurance, software, and any fixed salaries. For this example, let's say that total is $15,000.

Next, you need to figure out your variable cost per member. Think of things like payment processing fees or any other small costs that go up with each new sign-up. We can estimate this at $5 per member.

If you charge an average of $100 a month for a membership, your profit per member is $95. Now, to find your breakeven point, just divide your total fixed costs by that profit-per-member figure:

$15,000 (Fixed Costs) / $95 (Profit Per Member) = 158 Members

In this scenario, you need to sign up 158 members paying $100 a month just to cover your costs. That's your target. That's the number that tells you if your business model is sound.

Accelerating Profit with Smart Revenue Streams

Hitting your breakeven point is great, but blowing past it is the real goal. Just relying on basic memberships can be a slow, painful grind. The smart move is to stack your revenue streams to get into the green much faster.

Think beyond the monthly dues. Every square foot of your gym is a potential money-maker.

- Personal Training: This is a classic for a reason. Offer one-on-one sessions and small-group training packages.

- Group Classes: Specialized classes like yoga, HIIT, or cycling can often command a premium price tag.

- Retail and Concessions: Don't overlook the simple stuff. Selling branded t-shirts, supplements, and healthy snacks can add up significantly.

These extras don't just boost your average revenue per member; they also give people more reasons to love your gym, making them stick around longer.

Your Dashboard is Your Roadmap

You can't make smart decisions if you’re flying blind. Guessing at your key numbers—like revenue, member churn, and class attendance—is a surefire way to fail. This is why having an all-in-one gym management platform isn't a luxury; it's a necessity.

Fitness GM gives you a live dashboard that puts your most critical data right in front of you. You can see instantly what’s working and what isn’t, allowing you to make quick, informed decisions that actually drive revenue. This clarity is your roadmap from day one to building a sustainable, profitable fitness business.

To plan out your entire journey, check out the detailed steps in our complete guide on how to start a gym business.

Got Questions About Gym Costs? Let's Get Real.

You’re wondering what it really costs to open a gym. Let’s cut through the noise and get straight to the answers you need to build a solid budget and avoid the common money pits that trip up new owners.

What Is the Single Biggest Startup Cost?

Nine times out of ten, your biggest check will be for the facility itself. I'm not just talking about the equipment—I mean securing and preparing the physical space. This starts with the lease deposit, which can easily hit $10,000 or more right out of the gate.

Then comes the build-out. Depending on what you're starting with, renovations can range from a few thousand for a fresh coat of paint and new flooring to over $100,000 if you need to install locker rooms, upgrade the HVAC, or put in specialized lighting. Underestimating this cost is one of the quickest ways to blow through your startup capital before you even open the doors.

How Much Should I Budget for Monthly Expenses?

Your monthly "burn rate" is the number that will keep you up at night—or let you sleep soundly. For a small to mid-sized gym, a safe ballpark for monthly operating expenses is anywhere from $15,000 to $50,000.

This figure covers your fixed costs that you have to pay no matter what: rent, utilities, insurance, and software. It also accounts for variable costs that change with membership, like staff payroll, payment processing fees, and your marketing budget. Knowing this number inside and out is absolutely critical for pricing your memberships correctly and figuring out your timeline to break even.

The biggest operational drain isn't always rent—it's the silent killer of wasted time and lost revenue. Chasing failed payments costs you 28 hours a month, and fragmented software eats up another 12+ hours in manual admin work. An all-in-one system plugs these leaks for good.

How Can I Reduce My Ongoing Costs?

The most effective way to shrink your overhead is to automate the repetitive tasks that don't directly grow your business. Instead of paying someone just to be a warm body at the front desk, you could implement 24/7 access control. This one move can slash your payroll expenses by up to 40%.

Likewise, stop manually chasing down failed membership payments. A system like Fitness GM can handle that whole process automatically, from sending reminders before a card is due to retry failed payments. It recovers over 95% of that missed revenue without you lifting a finger. That puts thousands of dollars back in your pocket every month and frees up your time to focus on your members, not your paperwork.

Ready to eliminate the admin chaos and cut operating costs? Fitness GM is the all-in-one gym OS that automates billing, access, and scheduling so you can focus on running your gym, not your back office. Stop wasting time on clunky software and start capturing more revenue. Start your free 14-day trial.